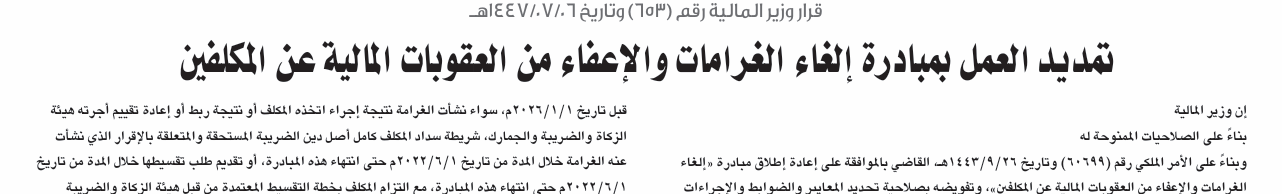

The Minister of Finance has issued a decision to extend the implementation of the “Cancellation of Fines and Exemption from Financial Penalties for Taxpayers” initiative for an additional six months, starting from 01/01/2026, as part of the ongoing efforts to ease the burden on taxpayers and encourage them to regularize their Zakat, tax, and customs positions.

The initiative covers the cancellation of many fines imposed on taxpayers due to late payment, late filing of returns, voluntary disclosure, or e‑invoicing violations, provided that the taxpayer settles the principal tax liabilities during the validity period of the initiative. It also links eligibility to benefit from the initiative to the taxpayer’s adherence to installment plans approved by the Zakat, Tax and Customs Authority when agreeing on scheduling the outstanding amounts, and it applies to all fines arising from the following taxes, except for tax evasion violations:

- Value Added Tax (VAT)

- Withholding Tax

- Income Tax

- Real Estate Transaction Tax (RETT)

- Excise Tax

The decision sets out a number of cases and conditions; most notably, the fines that are cancelled are those that remain unpaid as at the effective date of the decision, while fines that have already been paid are not subject to cancellation or refund. It also clarifies that the initiative does not extend to the principal amounts of tax or customs duties due, but is limited to the related fines and financial penalties, provided that the taxpayer settles the principal tax or customs amounts within the specified period.

The decision further confirms that the Authority has the discretion to cancel financial penalties for taxpayers who comply with the conditions of the initiative, including filing the required returns and paying the amounts due or submitting a request for installment arrangements, with a note that breaching the terms of the installment plan or failing to pay may lead to re‑imposing the fines in accordance with the applicable regulations.

This extension represents an important opportunity for both compliant and non‑compliant businesses and individuals to regularize their tax and customs positions by benefiting from the cancellation of fines in exchange for expediting the settlement of their core liabilities, which contributes to enhancing compliance and raising the level of voluntary adherence among taxpayers.

We can assist you in understanding the conditions of the initiative, assessing its applicability to your current situation, and identifying how best to benefit from it, and we would be pleased to discuss this with you upon getting in touch.